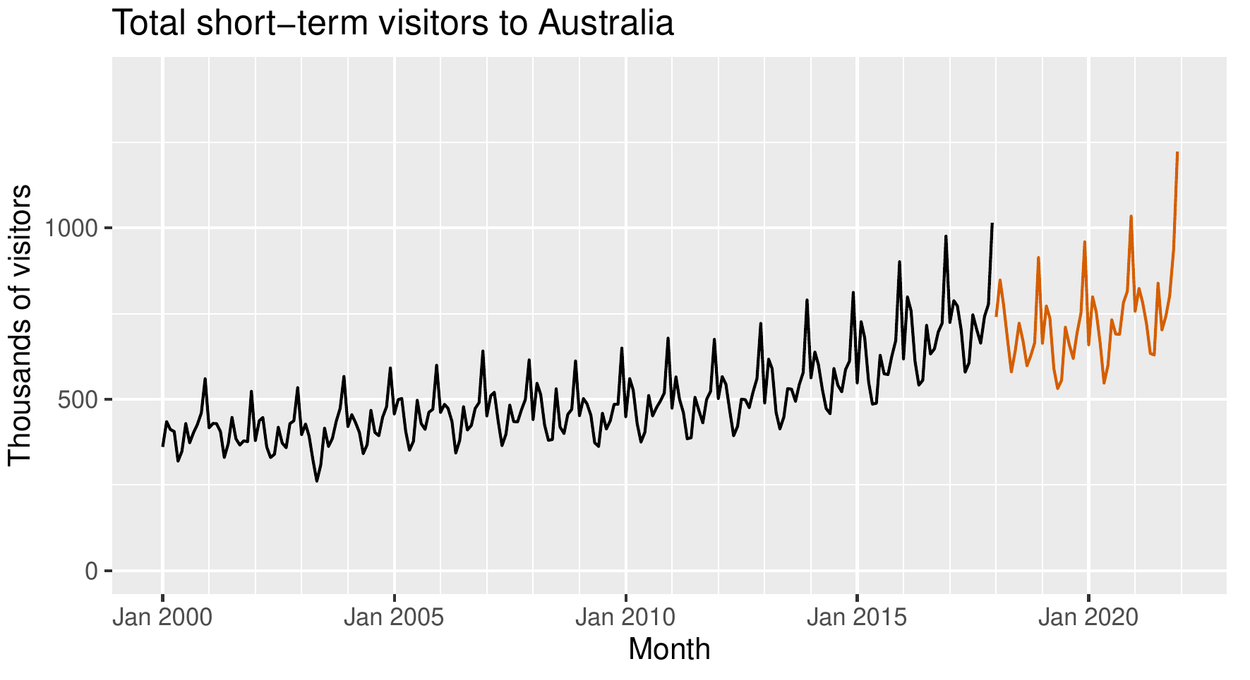

What can be forecasted easily?

daily electricity demand in 3 days’ time

Google stock price tomorrow

Google stock price in 6 months’ time

maximum temperature tomorrow

total sales of drugs in Australian pharmacies next month

Something is easy to forecast if:

we have a good understanding of the factors that contribute to it

there is a lot of data available

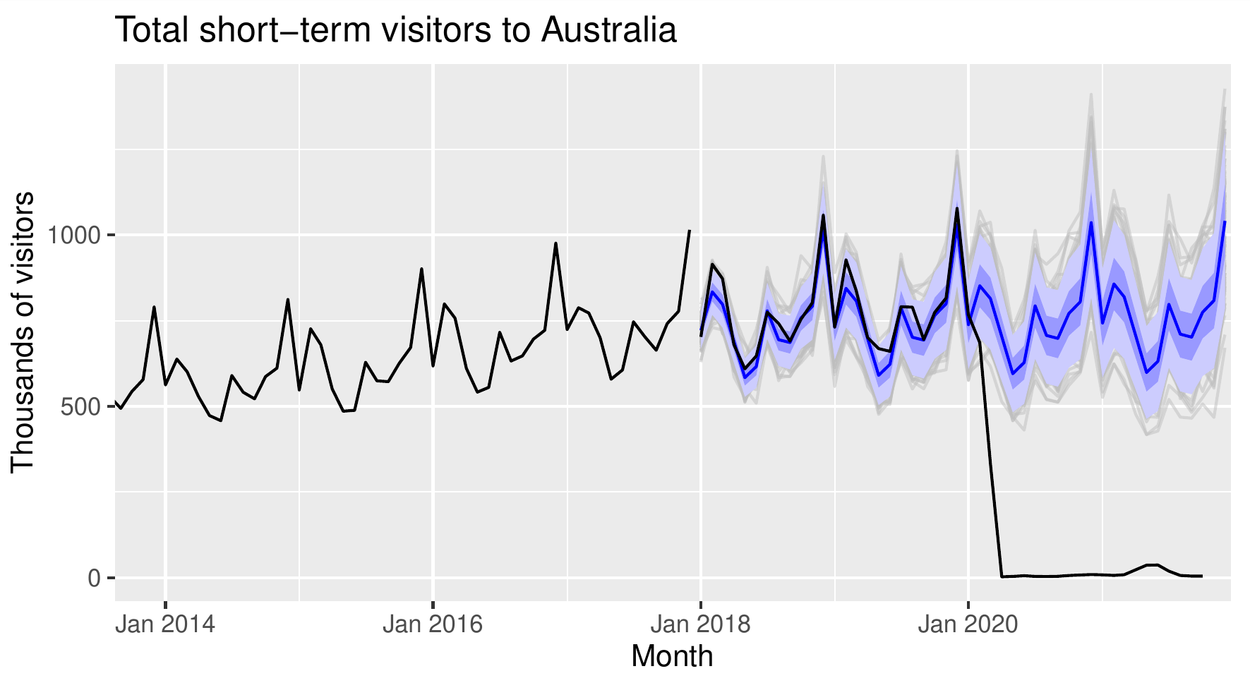

the future is somewhat similar to the past

ID assumption: samples are identically distributed

the forecasts cannot affect the thing we are trying to forecast.

self-fulfilling prophecies (election polls)

controlled systems

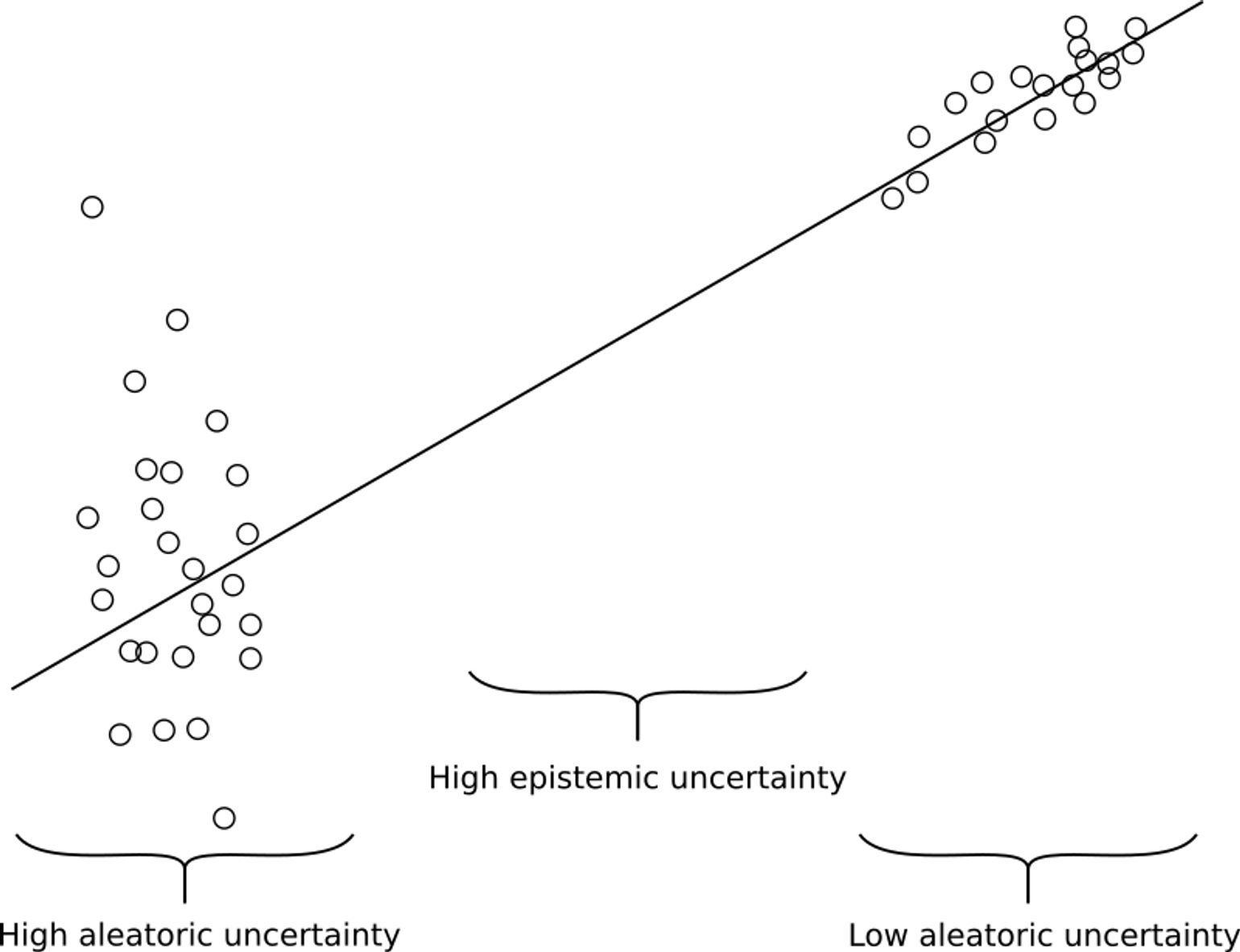

Dealing with uncertainty

Aleatoric (alea=latin for dice) or data uncertainty. This is the irreducible uncertainty that we cannot reduce by increasing observations.

simple case: homoscedastic (noise with fixed distribution)

more realistic case: heteroscedastic

Epistemic (epistḗmē=science) or model uncertainty. This uncertainty can be reduced by increasing observed data, and as such, can be reduced

Aleatoric or epistemic uncertainty?

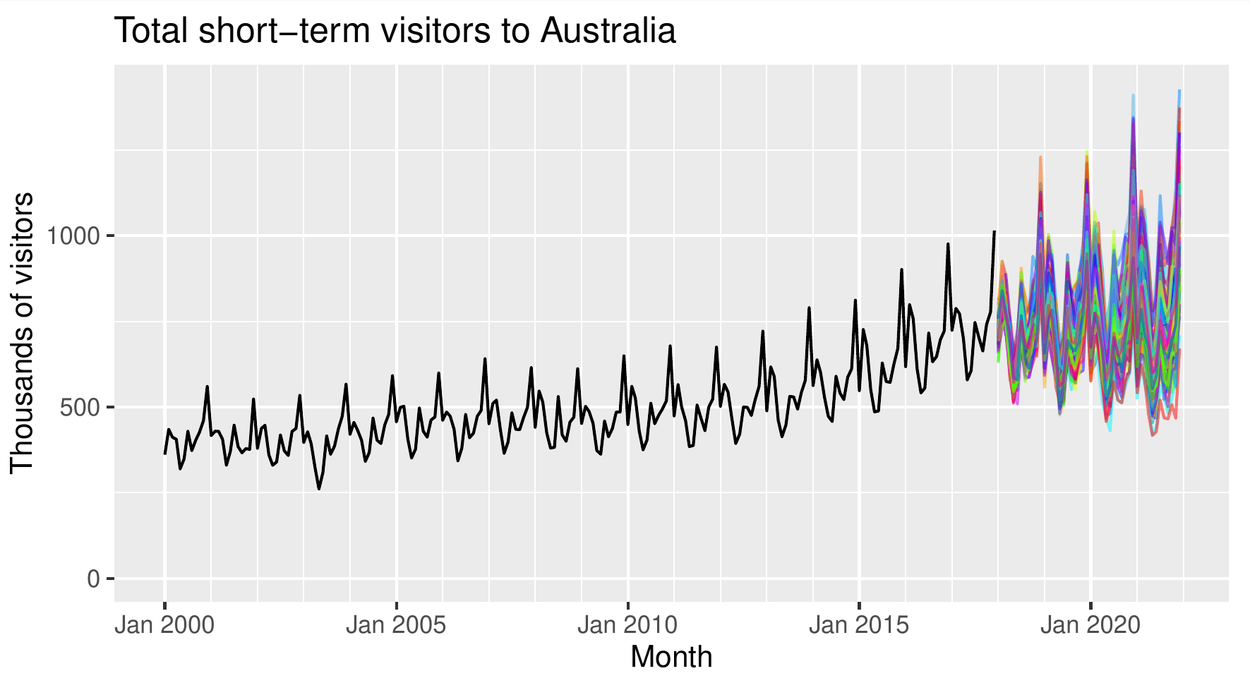

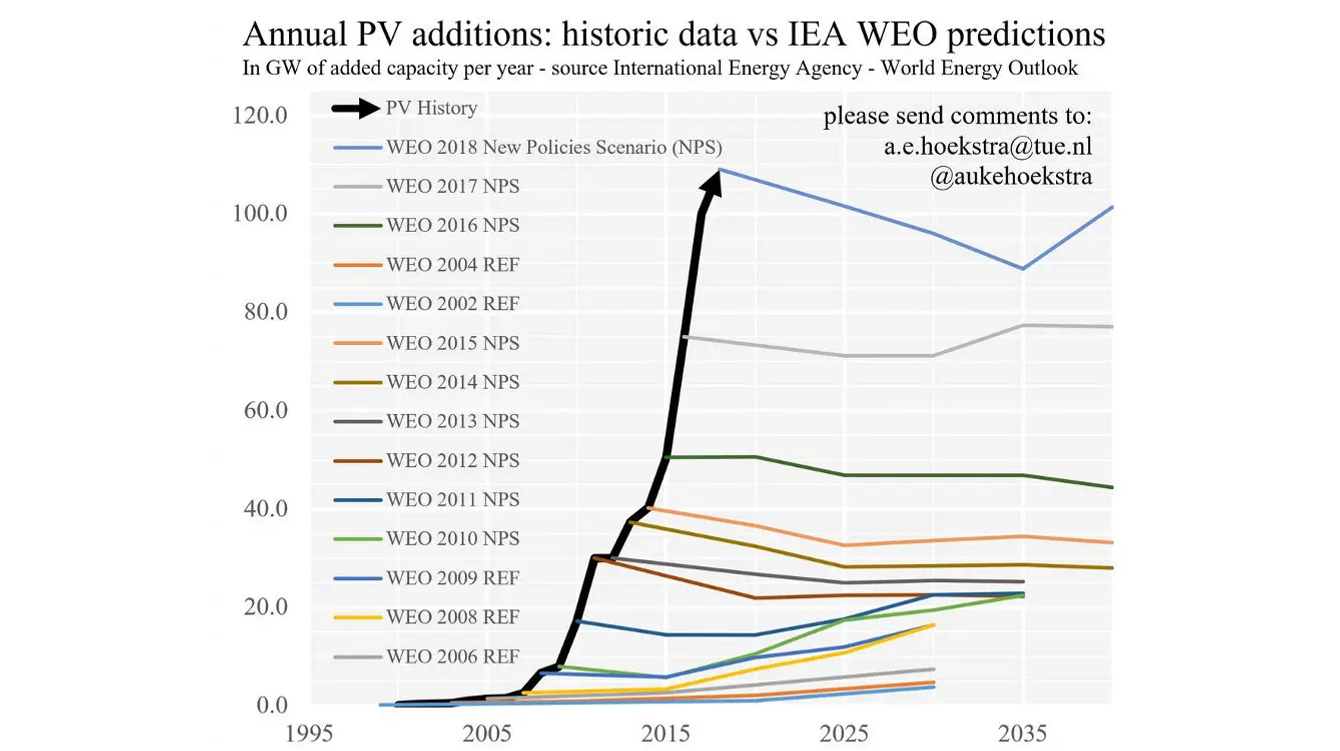

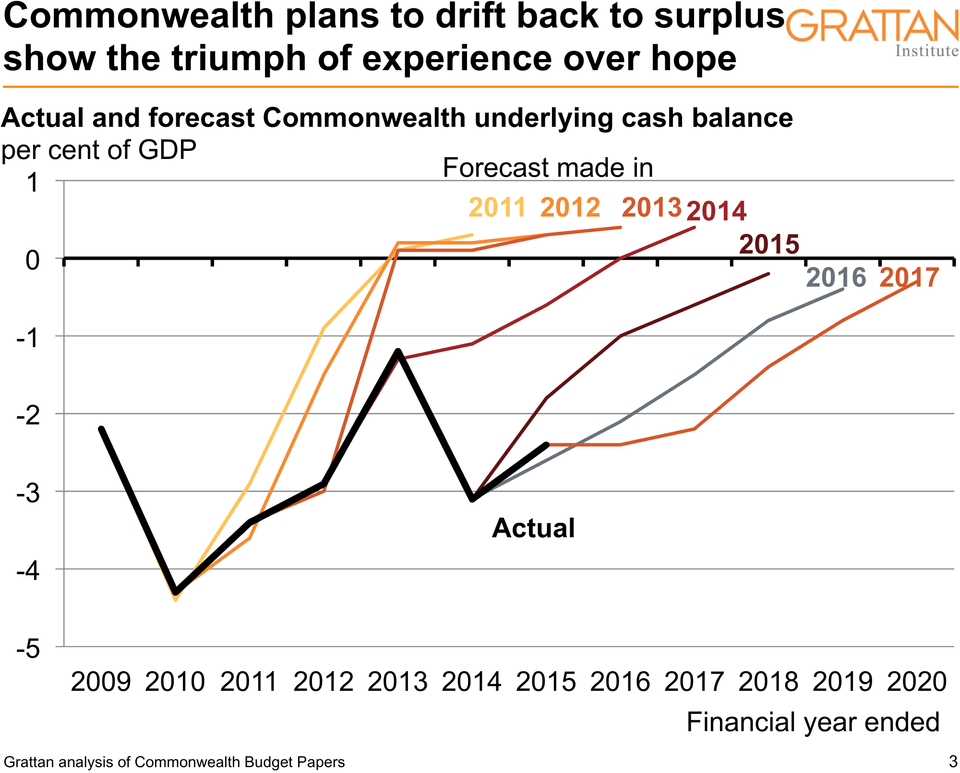

Another source of uncertainty: model choice

Model choice is another source of uncertainty, that can be mitigated by model selection. Unfortunately, it cannot correct ideological biases.

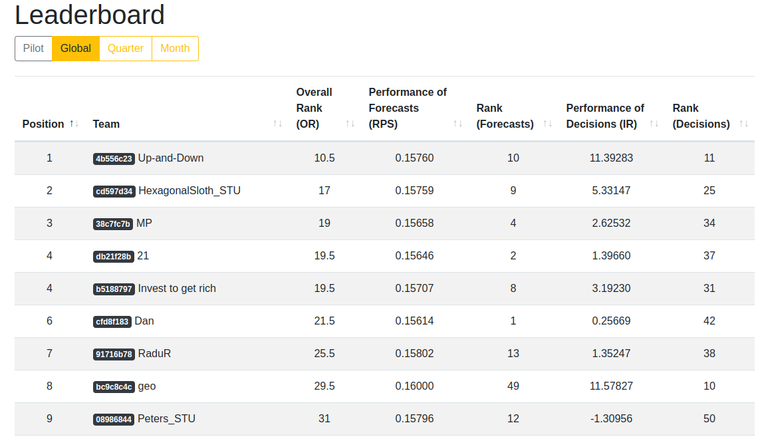

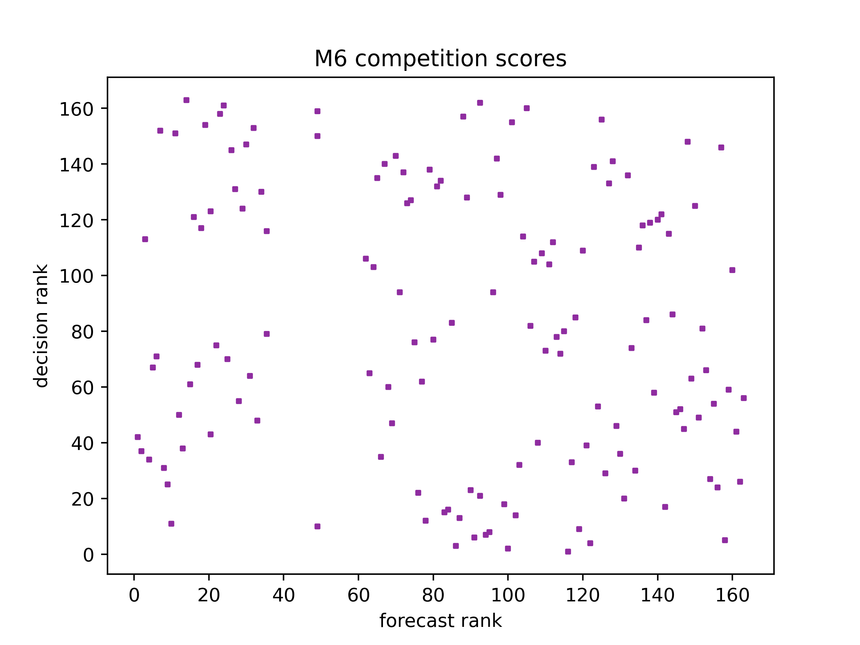

The M6 financial forecasting competition: 03-2022/ 01-2023

Its purpose is to shed new light on the EMH (Efficient Market Hypothesis) by explaining the poor performance of professionally managed funds

The competition committee made the following hypothesis:

There will be a weak link between the ability of teams to accurately forecast individual rankings of assets and risk-adjusted returns on investment

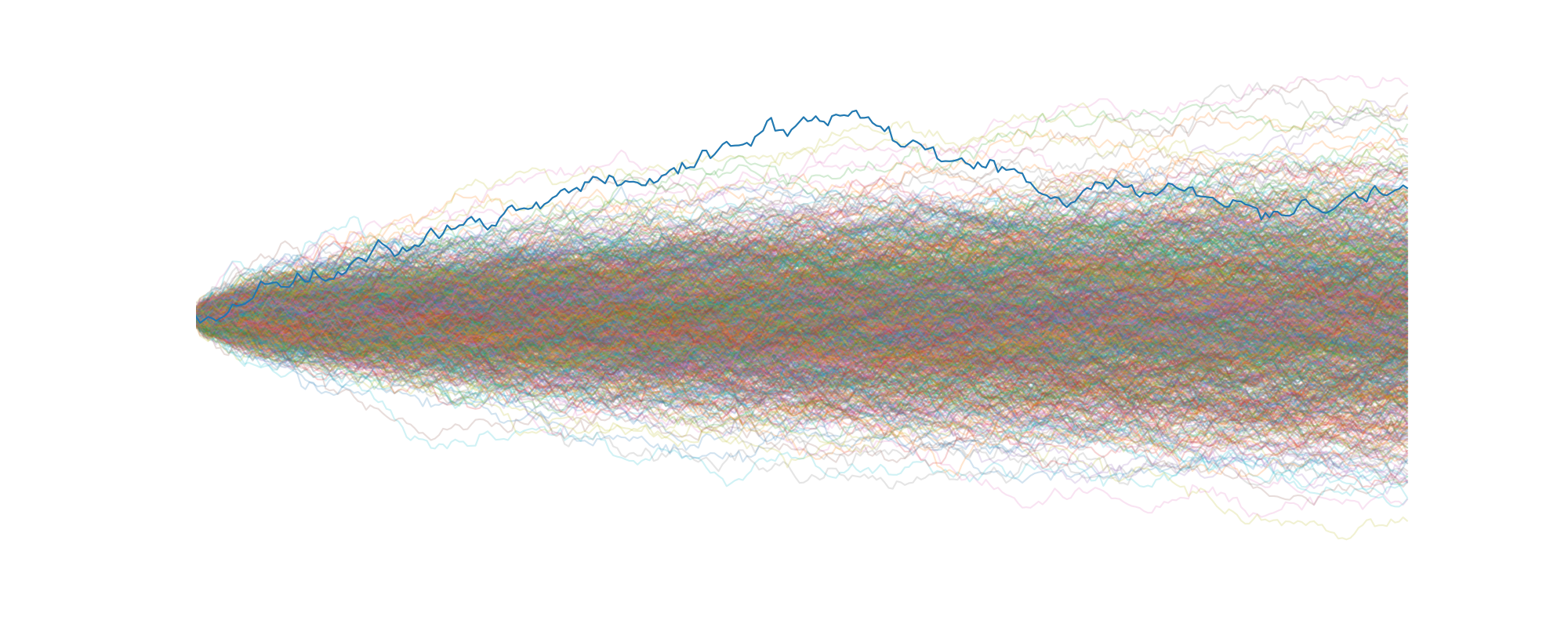

Decision-making and unforecastable signals

If some conditions are met, we can make informative decisions even if the underlying processes are not forecastable. Imagine you are a trader, which of the following signals you would like to forecast?

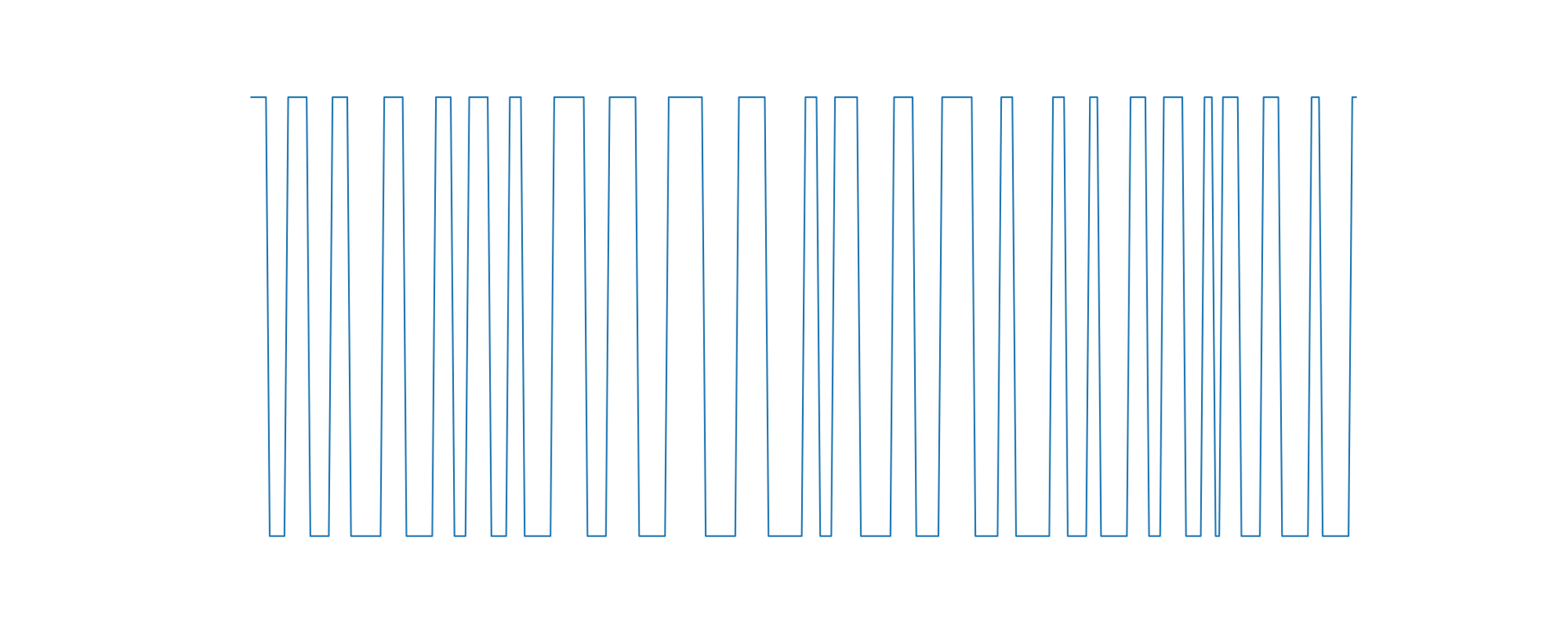

A pseudo-random binary signal

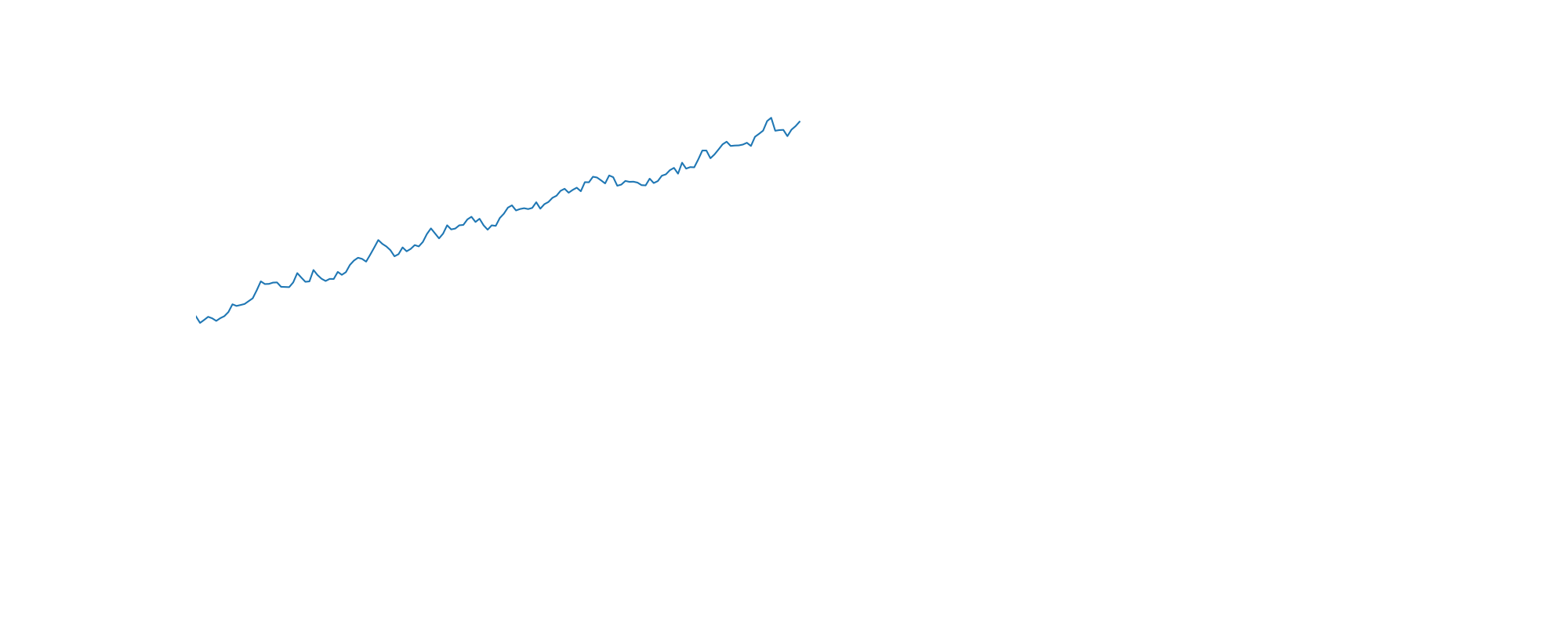

A noisy signal

One lucky realization